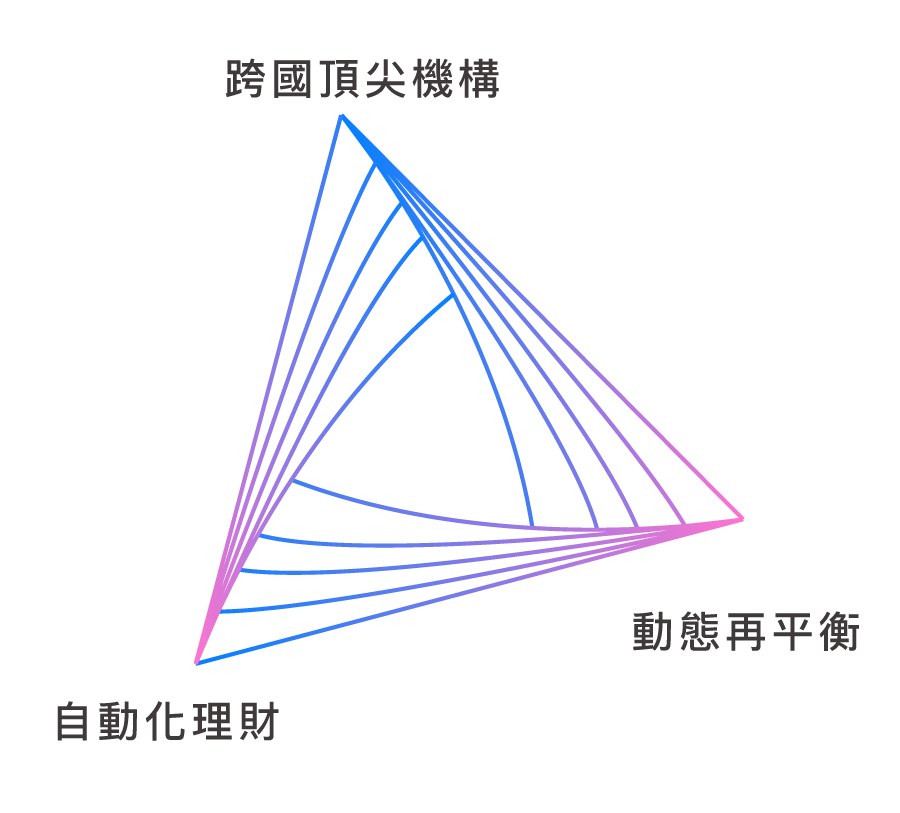

Nexus

Reasonable cost, sufficient information

Convenient interface allows you to invest in funds online with peace of mind

Play-to-EarnThe core concept is to enable players to gain benefits while playing

hasn't got time

hasn't got time I don't understand

I don't understand No experience

No experience